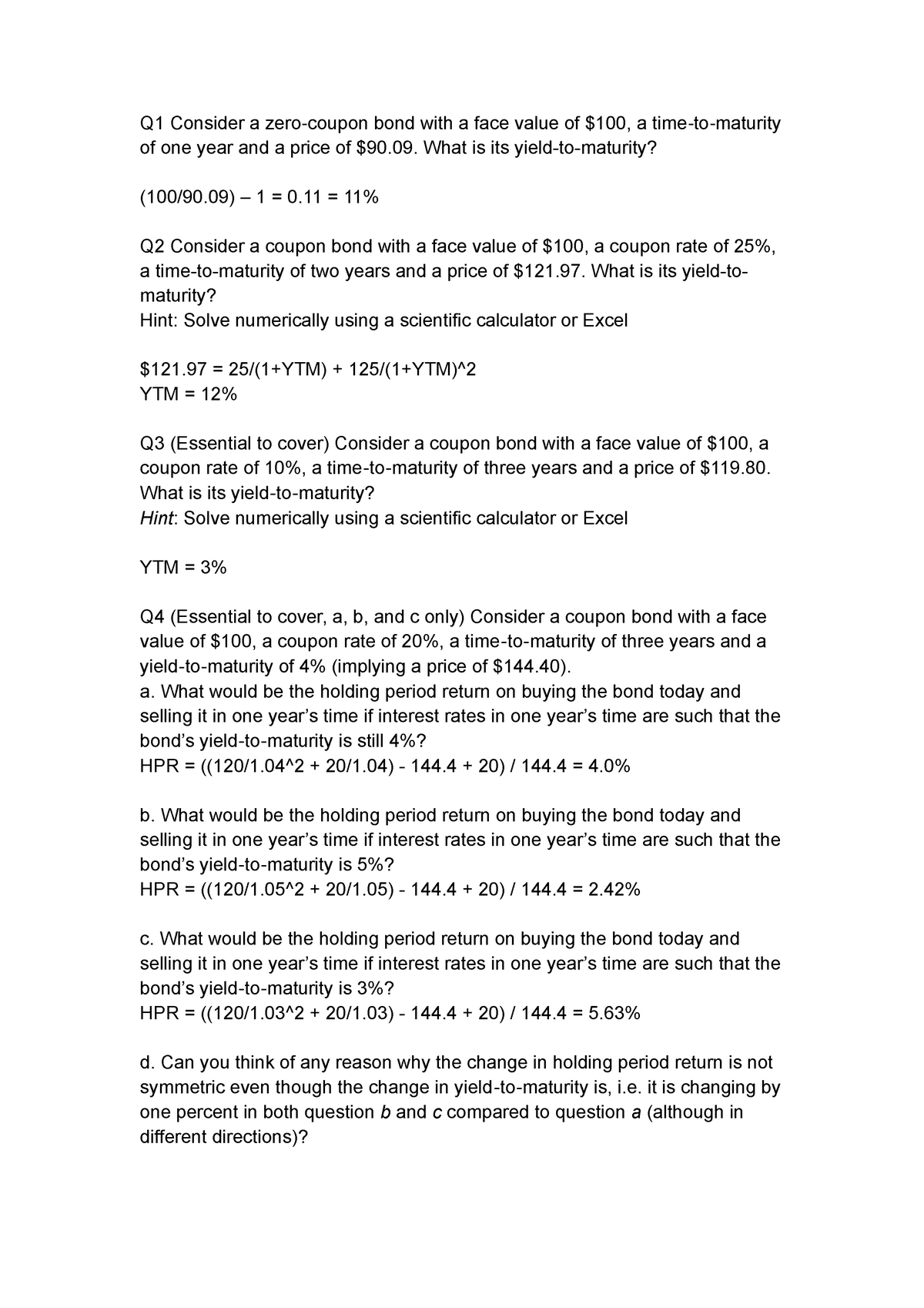

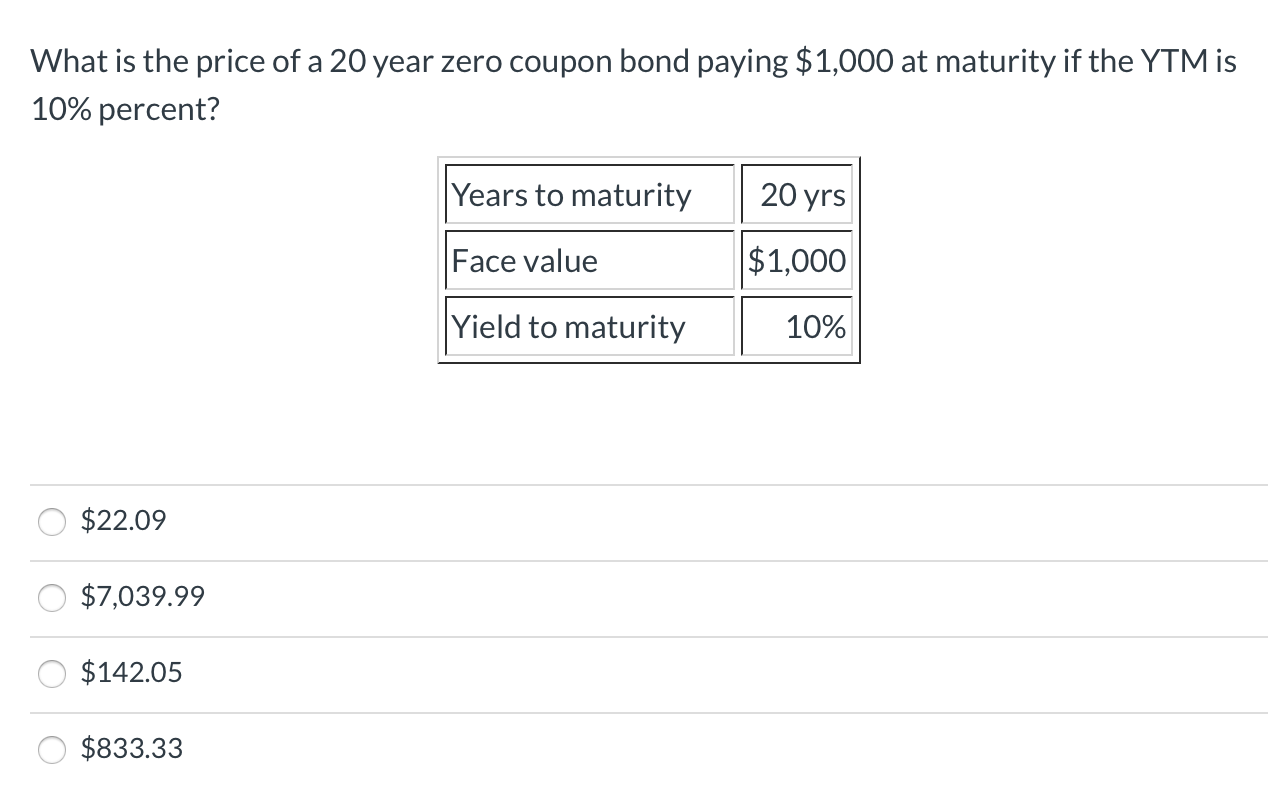

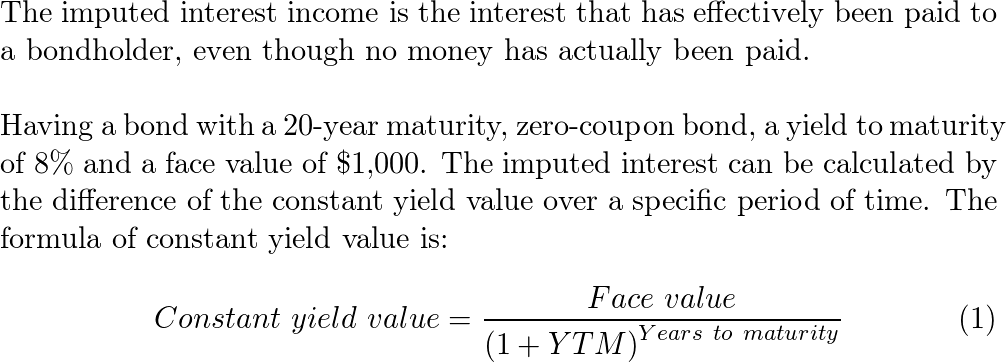

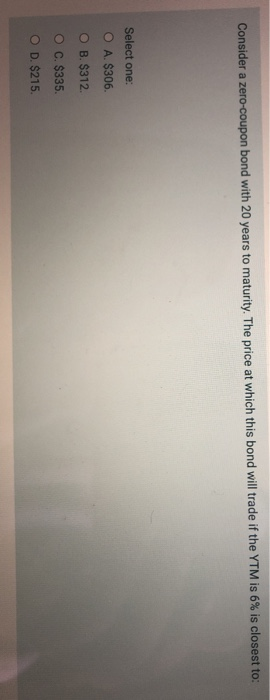

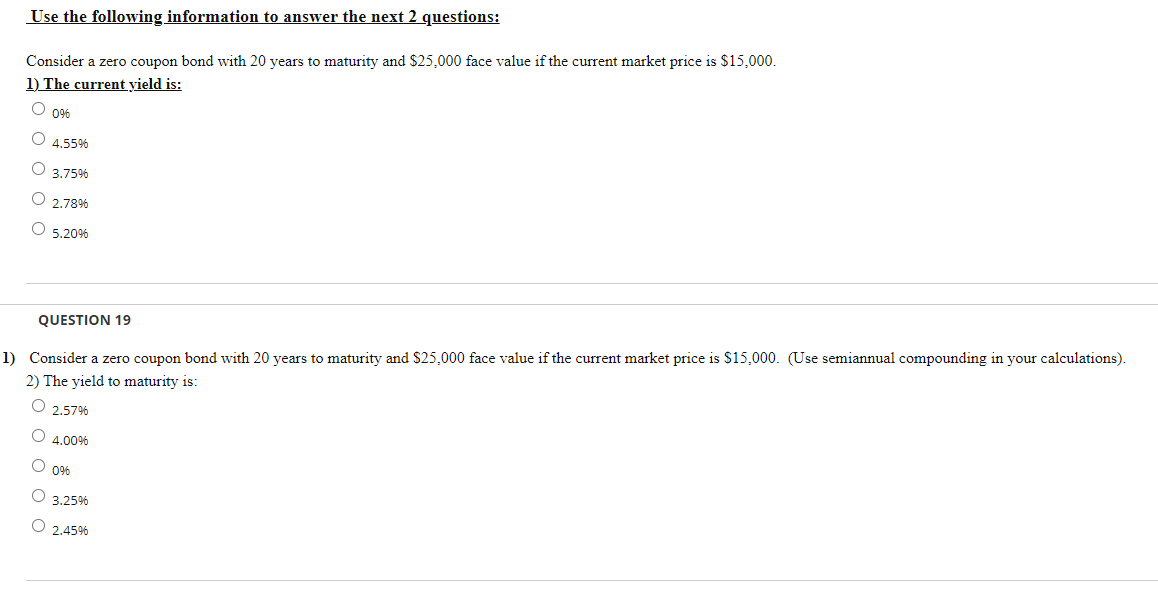

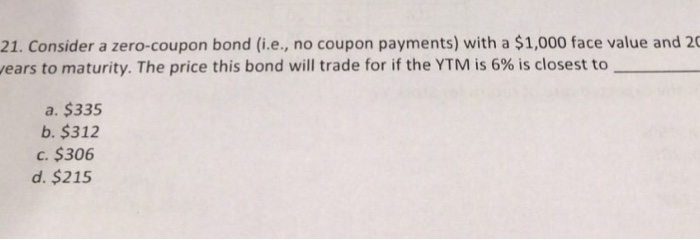

44 consider a zero coupon bond with 20 years to maturity

Finance - Wikipedia Personal finance is defined as "the mindful planning of monetary spending and saving, while also considering the possibility of future risk". Personal finance may involve paying for education, financing durable goods such as real estate and cars, buying insurance, investing, and saving for retirement. 7 Money Market ETFs to Buy for Safety - US News & World Report May 17, 2022 · Year to date through May 16, the SPDR S&P 500 ETF Trust (ticker: SPY) and iShares 20+ Year Treasury Bond ... and holds zero-coupon U.S. Treasury securities that have a remaining maturity of one-to ...

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Consider a zero coupon bond with 20 years to maturity

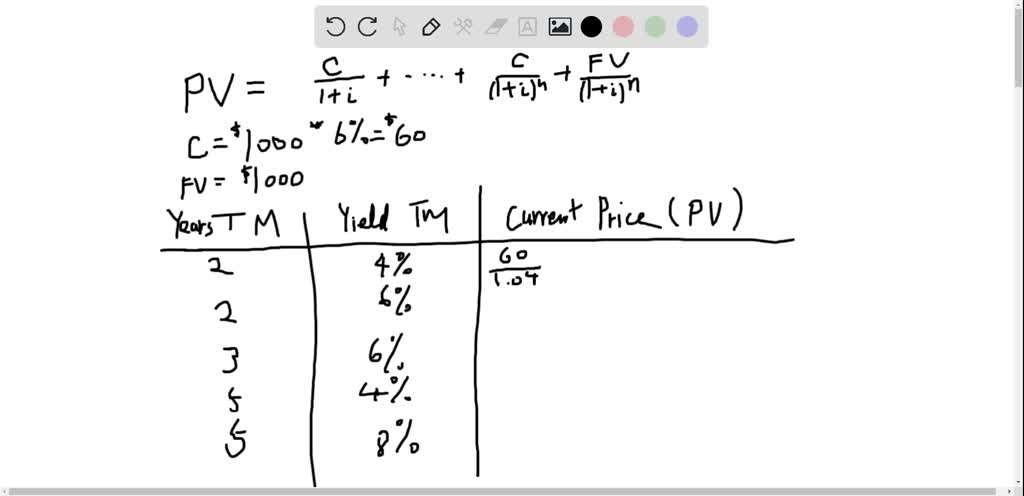

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · Assume, for example, that IBM issues a $1,000,000 6% bond due in 10 years. The bond pays interest semi-annually. $1,000,000 is the face amount or principal amount of the bond. That is the amount that must be repaid by the issuer at maturity. IBM (the issuer) must repay the $1,000,000 to the investors at the end of 10 years. The bond matures in ... The EU Mission for the Support of Palestinian Police and Rule ... Meet our Advisers Meet our Cybercrime Expert. Our Cybercrime Expert at EUPOL COPPS can easily be described as ‘a smile in uniform’. Esther Sense, an experienced Police Officer from Germany, holding the rank of Chief Police Investigator, joined EUPOL COPPS earlier this year and aside from her years of experience in her fields of expertise, has brought to the Mission a sunny demeanor that is ... Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Consider a zero coupon bond with 20 years to maturity. Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Consider an example where a bond pays a coupon of 5%. All issuances of this bond are sold at par value. Then, macroeconomic conditions in the world worsen, and the Federal Reserve begins lower the ... Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... The EU Mission for the Support of Palestinian Police and Rule ... Meet our Advisers Meet our Cybercrime Expert. Our Cybercrime Expert at EUPOL COPPS can easily be described as ‘a smile in uniform’. Esther Sense, an experienced Police Officer from Germany, holding the rank of Chief Police Investigator, joined EUPOL COPPS earlier this year and aside from her years of experience in her fields of expertise, has brought to the Mission a sunny demeanor that is ... How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · Assume, for example, that IBM issues a $1,000,000 6% bond due in 10 years. The bond pays interest semi-annually. $1,000,000 is the face amount or principal amount of the bond. That is the amount that must be repaid by the issuer at maturity. IBM (the issuer) must repay the $1,000,000 to the investors at the end of 10 years. The bond matures in ...

Post a Comment for "44 consider a zero coupon bond with 20 years to maturity"