44 zero coupon bonds advantages

Advantages Of Zero Coupon Bond - bizimkonak.com Zero Coupon Bonds - Taxation, Advantages. CODES (1 days ago) A zero-coupon bond is a preferred investment option since it is secured, especially if invested for the long term. Some of the benefits that these offers are: Predictable … Visit URL. Category: coupon codes Show All Coupons What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them...

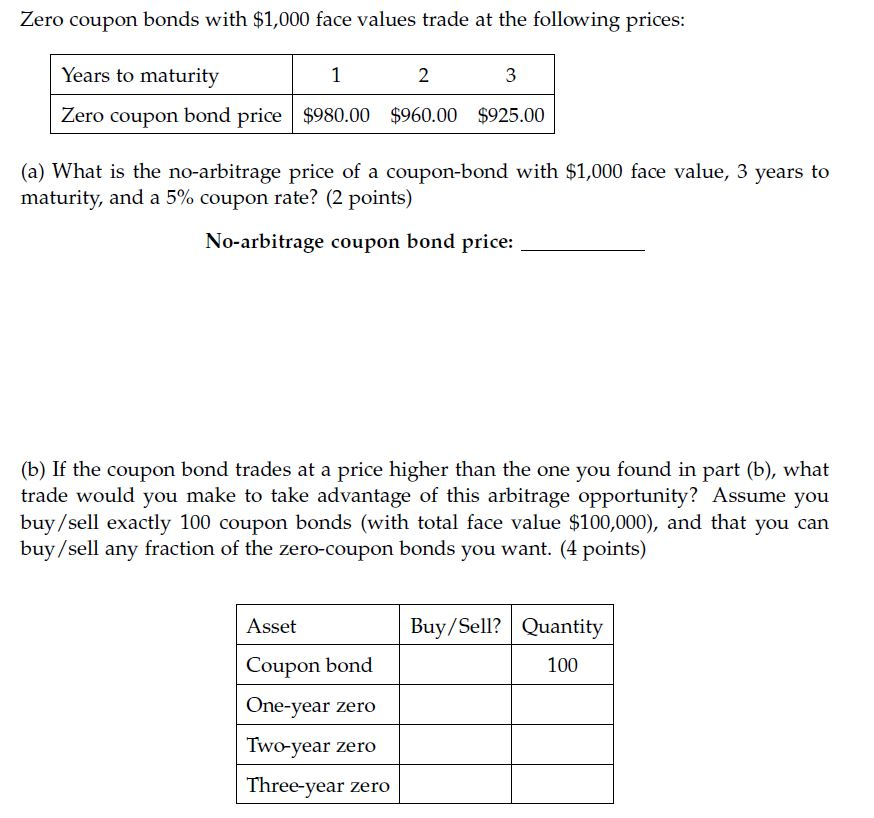

Zero-Coupon Bond - Definition, How It Works, Formula Extending the idea above into zero-coupon bonds - an investor who purchases the bond today must be compensated with a higher future value. Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds

Zero coupon bonds advantages

Pros and Cons of Zero-Coupon Bonds | Kiplinger Their big advantage is that you know how much you'll collect a certain number of years from now. In mid June, for example, you could have bought a U.S. Treasury zero for $341 that matures in August... PDF Compounding advantages of zero coupon municipal bonds and zero coupon ... Zero coupon convertibles are another zero coupon structure (could be taxable as well as tax exempt) that makes a great deal of sense. This type of bond is a combination of a zero coupon bond and a convertible bond. It is issued as a zero coupon bond that pays no interest until a specified date, when it converts to a coupon-paying bond with a ... What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N').

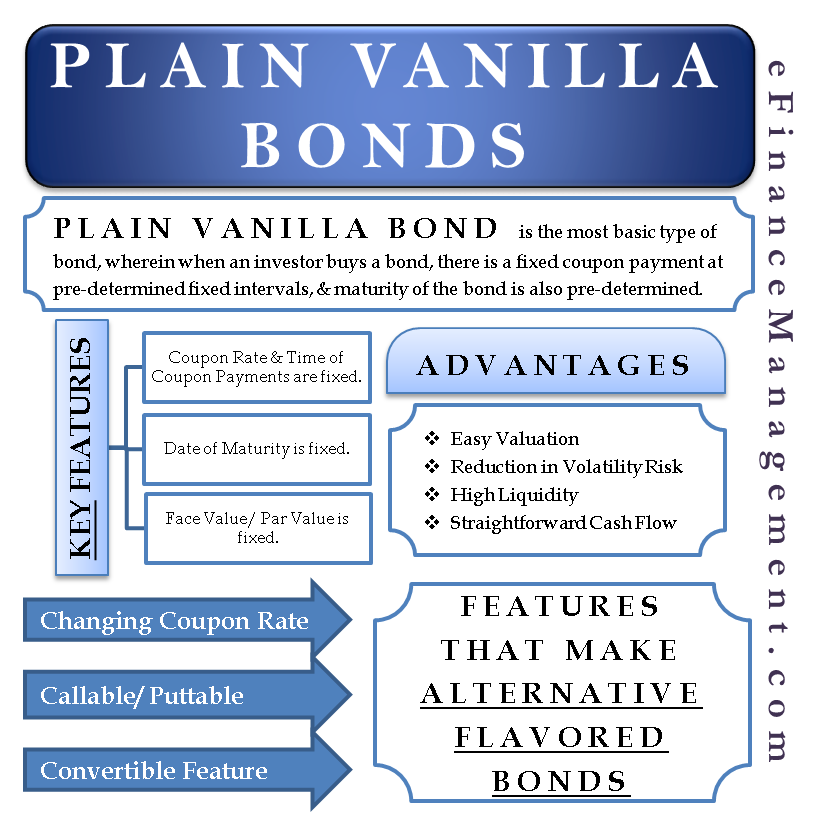

Zero coupon bonds advantages. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Advantages of Zero-Coupon Bonds. It is important to understand the advantages of a Zero Coupon bond before opting for this investment. The advantages are mentioned below: No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink What are the benefits of investing in Zero Coupon Bonds? Zero Coupon Bonds carries lesser risk with fixed income option. The return on these bonds is comparably higher as compared to other fixed income options. Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified ... What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Advantages #1 - Predictability of Returns This offers predetermined returns if held till maturity, which makes them a desirable choice among investors with long term goals or for those intending assured returns and doesn't intend to handle any type of Volatility usually associated with other types of Financial Instruments such as Equities, etc.

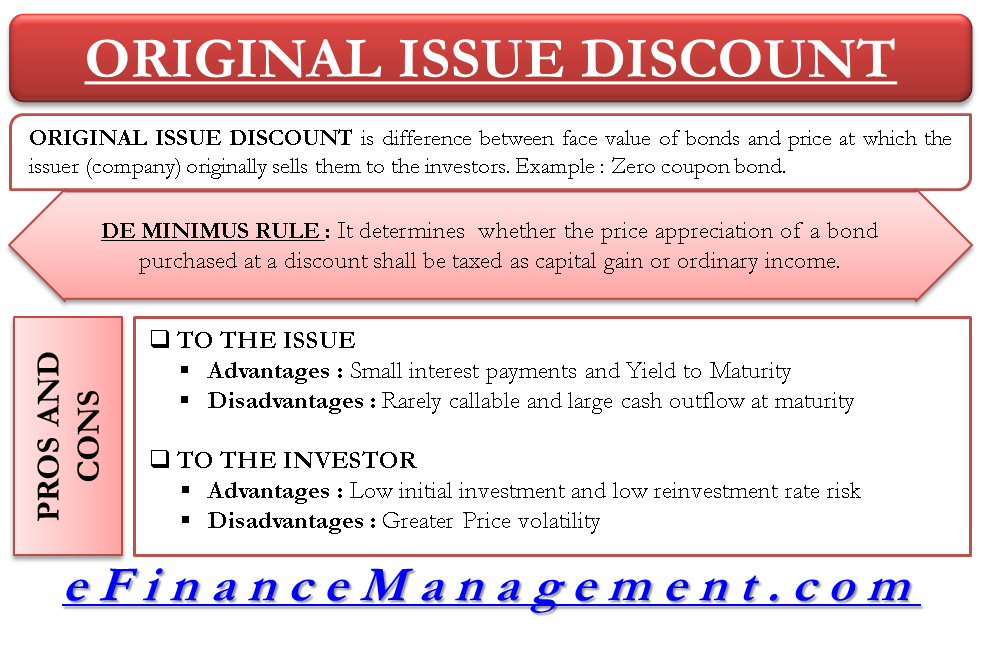

What are Zero Coupon Bonds? Explain some of its variants. Features, Advantages, and Disadvantages Zero-Coupon Taxability Long Term in Nature Conservation of Cash No Reinvestment Risk Highly Fluctuation Market Prices High Repayment Risk Taxability The return of a ZCB investor is long-term capital gain, whereas, for other normal bonds, it is an interest income. What is a Zero Coupon Bond? Who Should Invest? | Scripbox Following are the advantages of zero coupon bonds Significant returns on maturity These bonds are deep discount bonds that offer significant returns on maturity. Additionally, a bondholder can exit the bond by selling in the secondary market (stock market), in case the interest rates decline sharply. Fixed interest What are the advantages and disadvantages of zero-coupon bond? Originally Answered: What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival. Zero coupon bonds what are the advantages and - Course Hero 7. Zero-Coupon Bonds What are the advantages and disadvantages to a firm that issues low- or zero-coupon bonds? "Low-coupon bonds and zero-coupon bonds arelong-term debt securities that are issued at a deep discount from par value. Investors aretaxed annually on the amount of interest earned, even though much or all of the interestwill not be received until maturity.

Zero coupon bonds what are the advantages and - Course Hero ANSWER: From the perspective of the issuing firm, low or zero coupon bonds have the advantage of requiring low or no cash outflow during the life of the bond. The issuing firm is allowed to deduct the amortized discount as interest expense for federal income tax purposes, which adds to the firm's cash flow. The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Pros. One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates. This means that if you are alright with not receiving regular interest payments, you can actually make more money in the long run with zero coupon bonds. What is the disadvantage of issue zero coupon bond? - Quora Answer (1 of 2): The disadvantage is that zero coupon bonds are not appealing to many bond buyers. Bond issuers would like to borrow money at the lowest possible cost. And while the issuer may like the idea of not paying any interest until maturity, that benefit can be offset by the expense nece... Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Zero-Coupon Bond - an overview | ScienceDirect Topics In the US market zero-coupon bonds or "zeros" were first issued in 1981 and initially offered tax advantages for investors, who avoided the income tax charge associated with coupon bonds. 6 However the tax authorities in the US implemented legislation that treated the capital gain on zeros as income, thus wiping out the tax advantage. The ...

Zero-Coupon Bonds - Accounting Hub Advantages of Zero-Coupon Bonds. Zero-coupon bonds offer several benefits to issuers and investors. These bonds are less volatile and offer predictable returns to investors. Investors are assured of fixed income at maturity, so it eliminates the reinvestment risk as there are no periodic repayments. These bonds require a low initial investment.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Should I Invest in Zero Coupon Bonds? | The Motley Fool So, for instance, if you spent $750 on a 10-year $1,000 zero coupon bond, then the fact that the bond was priced to yield around 3% would mean that you'd have to pay tax on 3% of its value each ...

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Advantages of Zero-Coupon Bond. A zero-coupon bond is a secured form of investment when done for the long term. The various benefits it can provide are mentioned below: Predictable Returns: The return on a deeply discounted bond after maturity, is pre-known to the investor in the form of par value or face value.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. The...

What Is a Zero-Coupon Bond? - The Motley Fool Pros and cons of zero-coupon bonds. Table by author. Pros Cons Can be obtained at a significant discount to face value. Can be useful for settling obligations of known amounts at a specific date ...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide This is the reason why zero-coupon bonds have a higher annualized yield as compared to other bonds. This works out to be beneficial for investors who do not have a need for receiving immediate payments. No Reinvestment Risk: Zero-coupon bonds do not have any reinvestment risk. This is because the bond does not pay interest periodically.

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia The municipal zero-coupon bonds can help you save tax on the interest income. Advantages of Zero-Coupon Bonds Meet Long-term Goals Zero-Coupon Bonds don't offer regular interest. Instead, the earned interest is accumulated and paid at the maturity. It thus helps create funds that can help meet your long-term goals. Fixed Returns

Zero-Coupon Bond Definition - Investopedia Regular bonds, which are also called coupon bonds, pay interest over the life of the bond and also repay the principal at maturity. A zero-coupon bond does not pay interest but instead trades at a...

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N').

PDF Compounding advantages of zero coupon municipal bonds and zero coupon ... Zero coupon convertibles are another zero coupon structure (could be taxable as well as tax exempt) that makes a great deal of sense. This type of bond is a combination of a zero coupon bond and a convertible bond. It is issued as a zero coupon bond that pays no interest until a specified date, when it converts to a coupon-paying bond with a ...

Pros and Cons of Zero-Coupon Bonds | Kiplinger Their big advantage is that you know how much you'll collect a certain number of years from now. In mid June, for example, you could have bought a U.S. Treasury zero for $341 that matures in August...

/GettyImages-1169665828-e5e668e6aa454b60b5d06e110711eff3.jpg)

Post a Comment for "44 zero coupon bonds advantages"