40 zero coupon bond benefits

Convertible bond - Wikipedia Coupon: Periodic interest payment paid to the convertible bond holder from the issuer. Could be fixed or variable or equal to zero. Could be fixed or variable or equal to zero. Maturity/redemption date : The date on which the principal (par value) of the bond (and all … Understanding Bonds: The Types & Risks of Bond Investments Because bonds tend not to move in tandem with stock investments, they help provide diversification in an investor's portfolio. They also provide investors with a steady income stream, usually at a higher rate than money market investments Footnote 1. Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and …

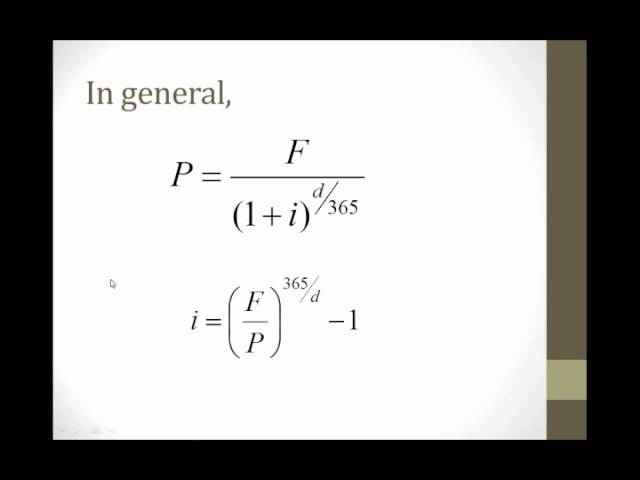

Calculate Price of Bond using Spot Rates | CFA Level 1 - AnalystPrep 27.09.2019 · Sometimes, these are also called “zero rates” and bond price or value is referred to as the “no-arbitrage value.” Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ...

Zero coupon bond benefits

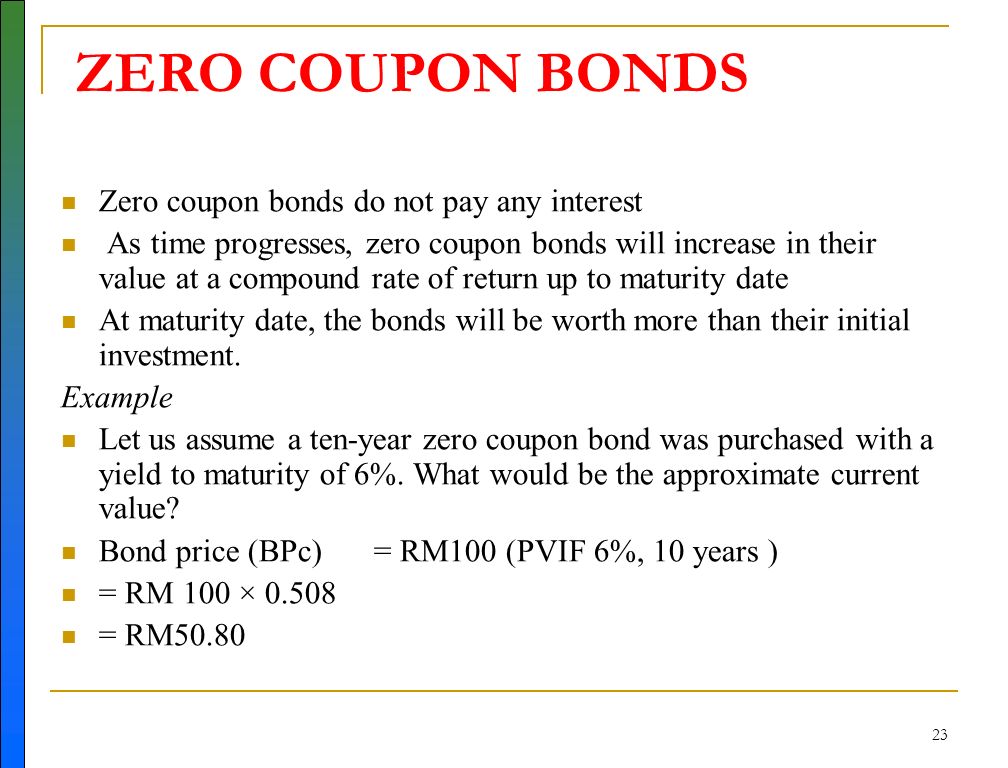

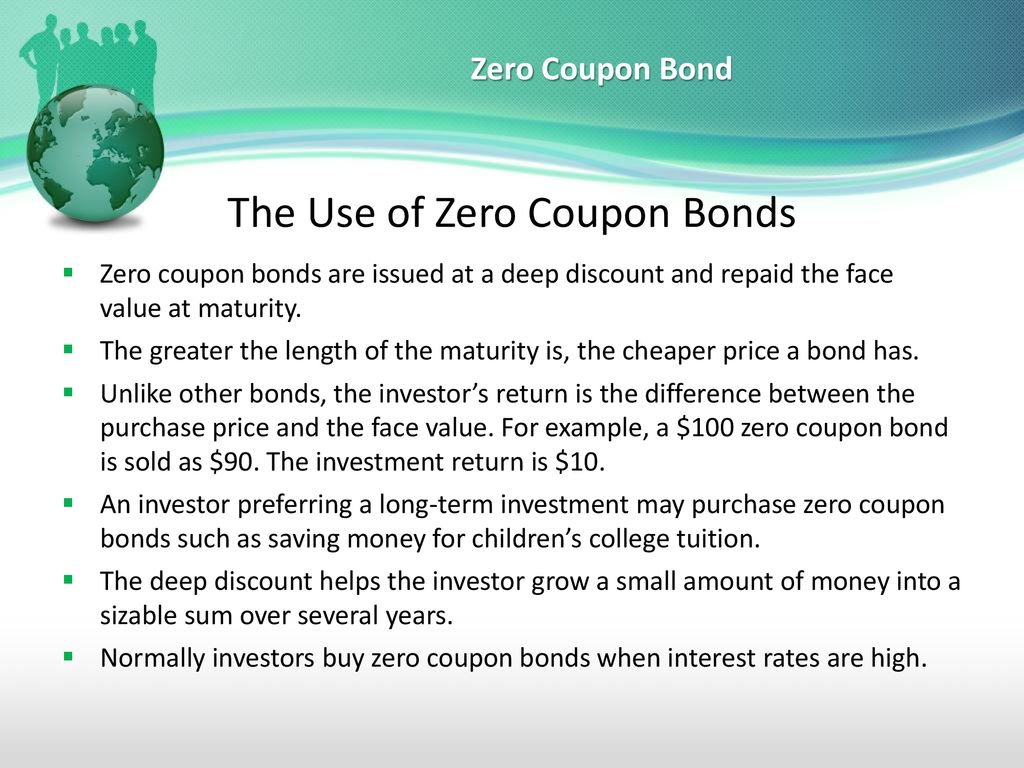

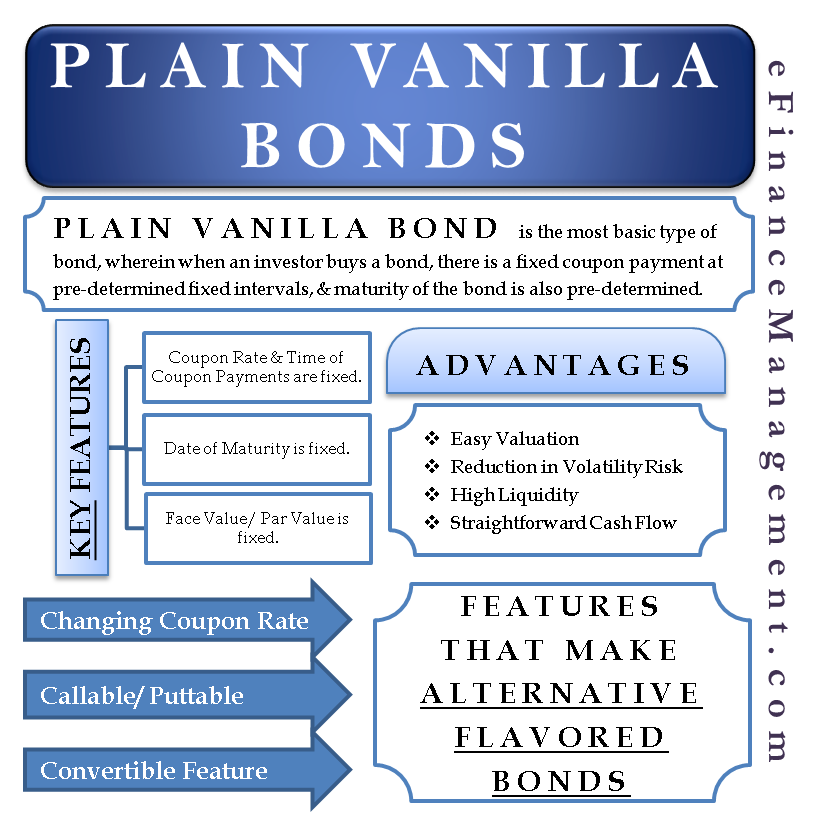

The Basics Of Bonds - Investopedia 31.07.2022 · What is the difference between a zero-coupon bond and a regular bond? 21 of 28. How Bond Market Pricing Works. 22 of 28. How to Create a Modern Fixed-Income Portfolio. 23 of 28. Where can I buy ... All the 21 Types of Bonds | General Features and Valuation | eFM 13.06.2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Bonds & Rates - WSJ News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

Zero coupon bond benefits. Sinking Fund Formula | How to Calculate Sinking Fund (Examples) Therefore, the company will be required to contribute a sum of $39,147 half-yearly in order to build the sinking fund to retire the zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · A zero-coupon bond is a debt security that doesn't pay interest but trades at a deep discount, rendering profit at maturity when it is redeemed. ... The Benefits and Risks of Being a Bondholder. Government Bonds: Types, Benefits & How to Buy ... - BondsIndia Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction. How Bond Maturity Works - US News & World Report 12.03.2020 · Issuers may want to redeem the bond early if interest rates change in a way that benefits them. A callable bond may have a stated maturity of 30 years, but the issuer may have the opportunity to ...

Warrant (finance) - Wikipedia Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce the interest rate that must be offered in order to sell the bond issue. Example. Price paid for bond with warrants ; Coupon payments C; Maturity T; Required rate of return r; Face value of bond F Bond Yield to Maturity Calculator for Comparing Bonds The Coupon – This is simply the interest rate on the bond. It is called a ‘coupon', because originally there would be a paper coupon attached to the bond that the owner would tear off and redeem for their interest payments. Of course, these days most interest payments are tracked, and paid, electronically. Still, the term persists. The coupon is expressed as a percentage of the … Bonds & Rates - WSJ News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. All the 21 Types of Bonds | General Features and Valuation | eFM 13.06.2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor.

The Basics Of Bonds - Investopedia 31.07.2022 · What is the difference between a zero-coupon bond and a regular bond? 21 of 28. How Bond Market Pricing Works. 22 of 28. How to Create a Modern Fixed-Income Portfolio. 23 of 28. Where can I buy ...

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "40 zero coupon bond benefits"